Outspending The US 2-To-1 And More: Report Gives New Insights Into China's Overseas Development Finance That Was Shrouded In Secrecy

China outspends the US two-to-one when it comes to international development financing. A report by AidData gives new insights about China’s loan deals with developing countries

Even as the Belt and Road Initiative (BRI) has become one of the most important tools for the Chinese Communist Party to secure its economic, political and security interests, its grant-giving and lending activity, an essential part of the project, remain shrouded in secrecy.

With China unwilling to reveal the details of its international development financing — it is the world's largest official creditor, and is highly secretive around the terms and conditions of its lending to developing countries — borrowers can't even reveal the existence of the loan in some cases, and this has made the study of the BRI and its outcomes difficult.

Now, a report — compiled by AidData, a research centre at the College of William and Mary in Virginia — which looks into 13,427 projects worth $843 billion across 165 countries over an 18-year period, gives new insights about China’s loan deals with developing countries.

Scale And scope of China’s Development Finance

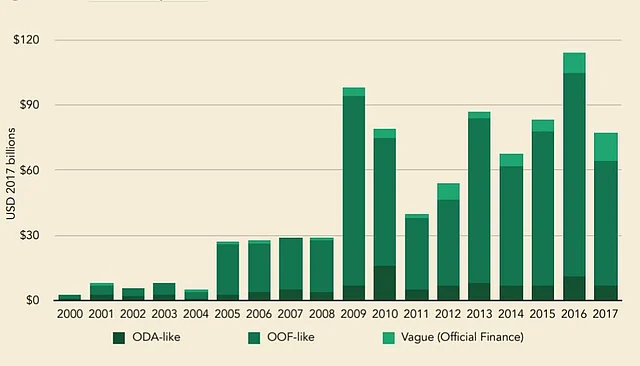

Between 2000 and 2012, the first 13 years of the 21st century, the development finance commitments of the United States and China were roughly the same at $34 billion and $32 billion, respectively.

But this changed drastically with the launch of the BRI, after which China's overseas development finance programme expanded to over twice that figure.

In the first five years of the implementation of the BRI (2013-2017), China’s yearly spending on overseas development financing reached $85.4 billion a year on average, while the US spent around $37 billion annually.

Beijing started outspending Washington on a more than two-to-one basis.

Official development finance commitments from China, 2000-2017. (AidData report)

The number of "mega projects" approved for finance by China with loans worth $500 million or more tripled during the first five years of the implementation of the BRI.

While only 11 loans worth more than $500 million were approved in an average year during the 13-year period preceding the BRI (2000-2012), 36 loans worth more than $500 million were approved in an average year during the first five years of BRI.

Nature of Financing

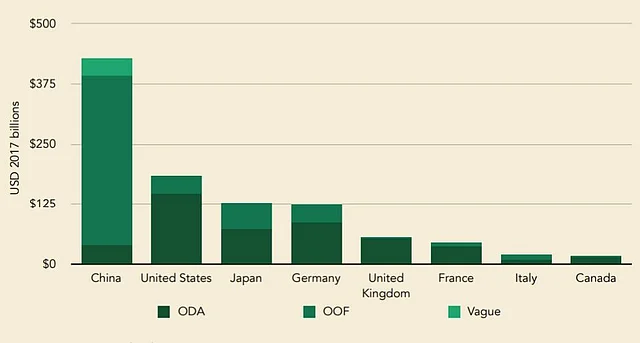

The nature of China's development financing is very different from that of the US and other major creditors such as Japan and Germany. While western countries have provided financing through grants and highly concessional loans, China has used debt rather than aid to establish a dominant position in the development finance market.

While 73 per cent of the US' international development finance between 2000 and 2017 was provided through grants and highly concessional loans, only 12 per cent of China's financing was made available via these routes.

Beijing instead used semi-concessional and non-concessional loans, export credits and other means for the disbursement of 81 per cent of its international development finance commitments.

"China has maintained a 31- to-1 ratio of loans to grants," the AidDatat report says, adding that the "behavior of other members of the G7 (Canada, France, Germany, Italy, Japan, the United Kingdom) more closely resembles that of the US than China".

International development finance from China and the G7, 2013-2017. (AidData report)

China's lending comes on less generous terms than loans given by OECD-DAC, bilateral creditors and multilateral development finance institutions. Official sector loans from China are also significantly less concessional than loans from the World Bank, the report adds.

"The internationally-accepted way of measuring a loan’s level of concessionality — i.e., the generosity of a loan or the extent to which it is priced below-market rates — is to calculate its “grant element”...between 2000 and 2017, the average grant element of a loan issued by an official sector institution in China was 28.4 per cent.

As of 2017, it was 35 per cent. Both figures are considerably lower than 97, the average grant element of loans (64 per cent) issued by OECD-DAC creditors," the report reads. China's loans have become bigger and riskier, creating the need for stronger repayment safeguards. This has led to China increasingly using collateralization in its high-risk, high-reward credit allocation strategy.

For example, it has adopted the practice of collateralizing loans against commodity export receipts when giving loans to resource-rich countries. This also secures the supply of energy and natural resources for China.

"At least 44 per cent of official sector lending from China is collateralized, while at least 17 per cent is backed by a repayment guarantee and at least 13 per cent is insured," the AidData report says.

Collateralization is used strategically, mostly in case of countries that suffer from high levels of corruption. As much as 83 per cent of of all the collateralized lending from official sector institutions in China between 2000 and 2017 supported countries scoring within the bottom quartile of the WGI Control of Corruption Index, the report found.

Creating Debt Burden

A large number of countries are facing debt distress because of the loans that they have contracted from Chinese state-owned entities, especially after the economic disruption caused by the Covid-19 pandemic.

In the past, China has used debt distress to its advantage by taking over assets, as seen in Sri Lanka, where Beijing took over the port of Humbantota. At least 44 countries now owe more than 10 per cent of their GDP to the Chinese government and could become victims of China's "debt trap".

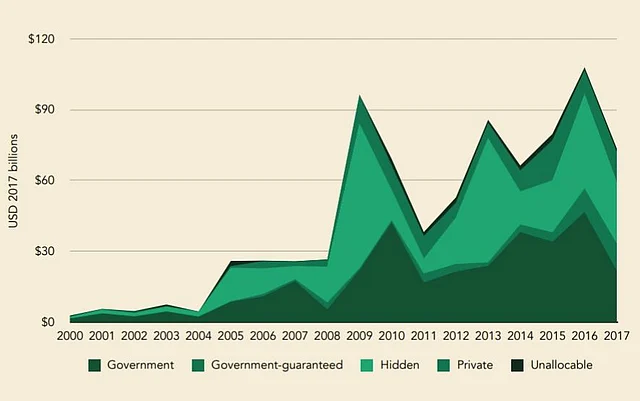

Unlike the pre-BRI era, 70 per cent of China's overseas lending is now directed to state-owned companies, state-owned banks, special purpose vehicles and joint ventures, and do not appear on the on government balance sheets.

This has created the problem of "hidden debts" as, in many cases, central government institutions in LMICs are not the primary borrowers responsible for repayment.

The report puts the underreported debts at approximately $385 billion.

China’s overseas lending portfolio by level of public liability, 2000-2017. (AidData report)

Laos, for example, has exceptionally high levels of sovereign debt exposure to China at 29.4 per cent of its GDP and hidden debt exposure at 35.4 per cent of its GDP. Laos’ overall level of debt exposure to China is equivalent to 64.8 per cent of GDP, the AidData report adds.

Problems Encountered by BRI projects

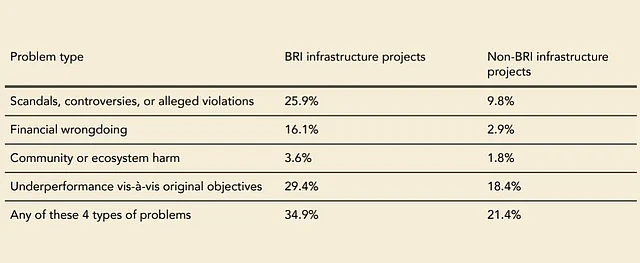

Over 35 per cent of projects under BRI have faced implementation problems such as corruption scandals, labour violations, environmental hazards, and public protests. This is significantly higher in comparison to projects outside the BRI, of which only 21 per cent have encountered problems such as these during implementation.

Because of implementation hurdles, BRI-linked projects take substantially longer to implement than non-BRI infrastructure projects financed by the Chinese government.

While it takes 1,047 days to implement a BRI-linked infrastructure project, a non-BRI projects financed by the Chinese government take 771 days for complete implementation.

More Chinese projects have been cancelled in the BRI era than in the post-BRI era. Corruption and overpricing are some of the issues over which host countries have cancelled Chinese-funded BRI projects.

BRI Vs non-BRI infrastructure projects that reference a problem type, by % of transaction values.

"BRI infrastructure projects are less likely to face major problems during implementation when they are undertaken by host country organizations. They are also less likely to face major problems when they are implemented by organizations that are neither from China nor host countries," the report says, suggesting that the level of distrust against China remains high despite its rapidly expanding economic and political influence, and at a time when the G7 plans to counter the BRI with an alternative in the form of the Build Back Better World (B3W) initiative.

No comments:

Post a Comment