Analysing The Trends In China-Pakistan Arms Transfer

China's CAC FC-1 Xiaolong fighter jet

The Beijing-Islamabad bonhomie is a given fact for making strategic calculations in the subcontinent. The trade in air-domain includes air defence systems and transport/reconnaissance helicopters, which indicates the multidimensionality of China-Pakistan arms trade

by Ambuj Sahu

China and Pakistan have a long history of camaraderie together going back to the early 1960s. The origin of their “all-weather” relationship is believed to be centred around their common perceptions of seeing a competitor in India. The two Asian giants fought a brief war in 1962, fuelled by the different territorial claims by both countries. On the other hand, India and Pakistan have inherited a border dispute since independence, which got repeatedly manifested in armed conflicts – in 1948, 1965 and 1971. China took a pro-Pakistan stance in the Indo-Pak wars of 1965 and 1971.

As far as the conventional arms transfers from China to Pakistan are concerned, they became significant from the mid-1960s. These developments were exacerbated by the US sanctions – first, in 1965 and then, after the initiation of Pakistani nuclear programme in 1979 – to the extent that by the early 1980s, almost 75% of tanks being used by the Pakistan Army and 65% of the aircraft used by the Pakistan Air Force (PAF) were of Chinese origin. China allegedly had a vital role in the technology transfer to Pakistan for its nuclear and missile programmes.

This article takes a data-driven approach to understand the trends in arms transfer from China to Pakistan over the last decade (2009-18). It attempts to address two main questions. First, how has the defence trade equation between both countries evolved in the last ten years? Secondly, what kind of arms has China supplied to Pakistan during this period?

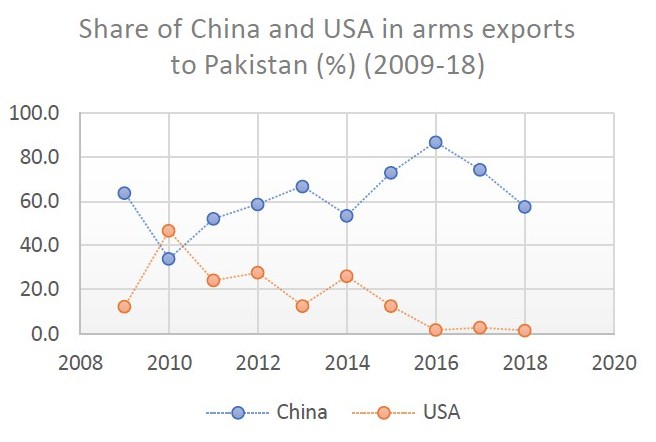

China-Pakistan Defence Trade

Demonstrates the share of China and USA of total arms exports to Pakistan from the period 2009-18. China continues to be the largest arms importer to Pakistan whose share is steadily increasing, especially over the last five years. It is evident from the rise in the average percentage share of China from 58.42% in 2009-18 to 69.12% in 2014-18. After the inauguration of CPEC in 2015, the port of Gwadar is seen as the alternative to Malacca straits amidst rising tensions in the Indo-Pacific region. The political stability of Pakistan has been a primary concern for Chinese plans to succeed. However, the fall in the percentage values of China’s share in arms exports to Pakistan for the year 2017 and 2018 are one-off deviations explained by the defence deals of Pakistan with Italy and Turkey respectively.

China continues to be the largest arms importer to Pakistan whose share is steadily increasing, especially over the last five years.

The US-Pakistan arms trade has gradually declined from 2009-18, and has fallen to an all-time low in past three years (2016-18). It reflects in the hardened stance of the Trump administration on Pakistan due to its failure to crackdown against terrorist outfits on their territory. This culminated in the withdrawal of US aid to Pakistan worth $300 million in September 2018. Thus, the rise of Chinese arms exports in Pakistan can also be attributed to the sluggishly deteriorating US-Pak strategic ties since 2016.

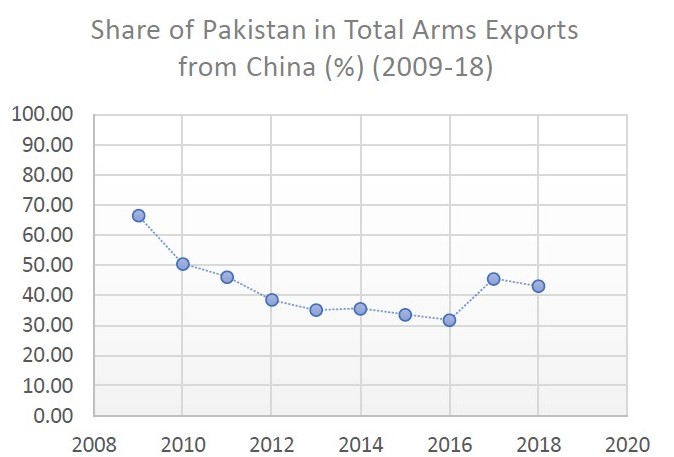

Below figure shows the share of Pakistan in the total arms exported by China from 2009-18. Although Pakistan remains the largest arms market for Pakistan, the steadily declining trend suggests that Beijing has been diversifying its arms market over the last decade. This development coincides with the Chinese bid to compete with the United States for the global superpower spot.

As Pakistan is no more primarily patronised by the United States, it is growing dependent on China for its security commitments. From Fig. 1 and Fig. 2, it is observed that the contribution of China in Pakistan’s arms imports has been increasing at the same time when Pakistan is losing its share in the Chinese arms exports market. The trend suggests that the customer base for Chinese arms markets has diversified across the globe due to which Beijing gains a leverage over Rawalpindi to coerce on their own terms of trade. On the other hand, Rawalpindi will be forced to comply with Beijing’s terms because of their growing dependence on the latter. It affirms the view that the China-Pakistan military relationship will be heavily skewed in the future.

On further analysis, it was found that Pakistan, Bangladesh and Myanmar have been the top-three arms recipients from China in the past ten years – their Trend Indicator Values (TIVs) being 6177, 1919 and 1272 (in millions) respectively. The data sounds alarming for New Delhi because it shows that the military footprint of China in the subcontinent is not limited to its geopolitical designs but also involves the armament of its neighbours, on both eastern and western fronts.

Classifying the arms imported to Pakistan (2009-18)

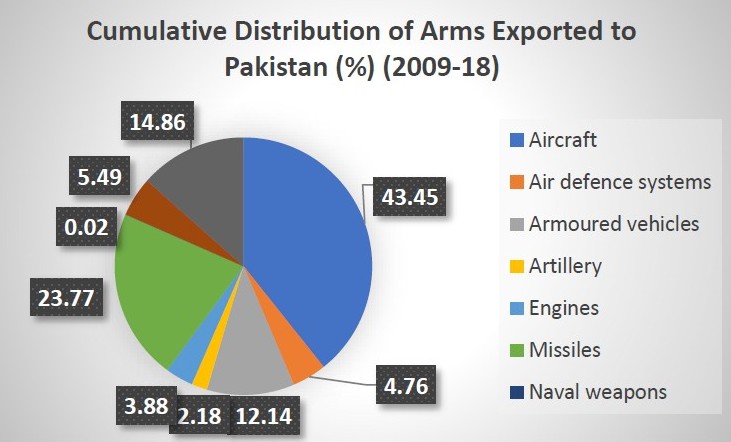

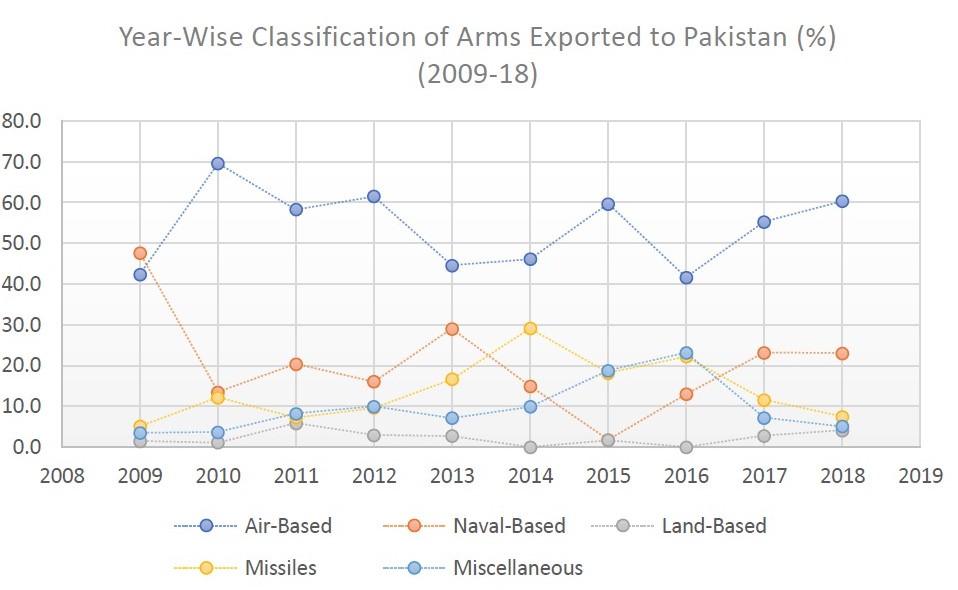

The weapon-wise classification of total arms imported by Pakistan from all countries in 2009-18 suggests that it has focused on furthering its air capabilities which involves procurement of varied weaponry like light combat aircraft, helicopters, and airborne early warning & control (AEW&C) systems, predominantly from China, USA and Italy. Aircraft and air defence systems combined formed 48.21% of total arms exported. Moreover, this air defence build-up is more gradual than sudden, indicating a sustained Pakistani strategy of militarising the skies shows the weapon-wise yearly distribution of the arms bought by Pakistan in the period 2009-18. As air-based systems persistently dominate the annual data since 2010, the resources poured by the Pakistani Armed Forces to develop conventional air-force capabilities cannot be denied.

China has transferred a wide range of aircraft, air missile systems and ballistic missiles in the last decade. For instance, JF-17 Thunder, a single-engine multi-role light fighter jointed developed with China, has been the pivotal component of air operations for Pakistan in recent years. Most of the missiles and guided bombs supplied by China are also compatible with the JF-17s. In 2015, the Karakoram Eagle-03 (Chinese ZDK-03 based AEW&C system) was inducted in the Pakistani squadrons after a $278 million deal. Pakistan and China have also been working on the production of Unmanned Aerial Vehicles (UAVs) including Caihong-5 and Wing Loong-I. The trade in air-domain also includes air defence systems and transport/reconnaissance helicopters, which indicates that the multidimensionality of China-Pakistan arms trade. Although a comprehensive military partnership, the ball is expected to move into Beijing’s court in the future due to their increasingly asymmetric relationship.

Despite ever-expanding spheres of cooperation between both countries such as infrastructure and transport development, financial integration and cultural exchanges under the umbrella of China-Pakistan Economic Corridor (CPEC), the Chinese officials believe that military cooperation forms the backbone of their relationship. The Beijing-Islamabad bonhomie is none the less then, a given fact for making strategic calculations in the subcontinent. Moreover, the downing of MiG-21 Indian Air Force (IAF) aircraft by the Pakistan Air Force (PAF) JF-17 (unconfirmed) following the Balakot air-strikes in Feb 2019 should be seen as a wake-up call by the military establishment in India. Although the IAF is numerically stronger than its Pakistani counterpart, the IAF Soviet-era MiG-series aircraft deployed for air defence are antiquated as compared to the PAF JF-17s and US-supplied F-16s. Keeping an eye on the air-power capabilities of Pakistan as well as undergo air arsenal upgradation and logistical modernisation becomes necessary for New Delhi after the trends in its arms build-up data are identified.

No comments:

Post a Comment